The Myth of the “Lucky Break”

Two poker players sit at a table. One relies on hunches and hopes for a lucky hand. The other studies’ patterns calculate odds and bets strategically. Who do you think leaves richer? Spoiler: It’s not the gambler.

The same applies to wealth. While luck might hand someone a fleeting win, lasting wealth is built like a master chess game—move by deliberate move. Let’s debunk the “overnight success” fairy tale and dive into the playbook of proven strategies that turn dreams into dollars.

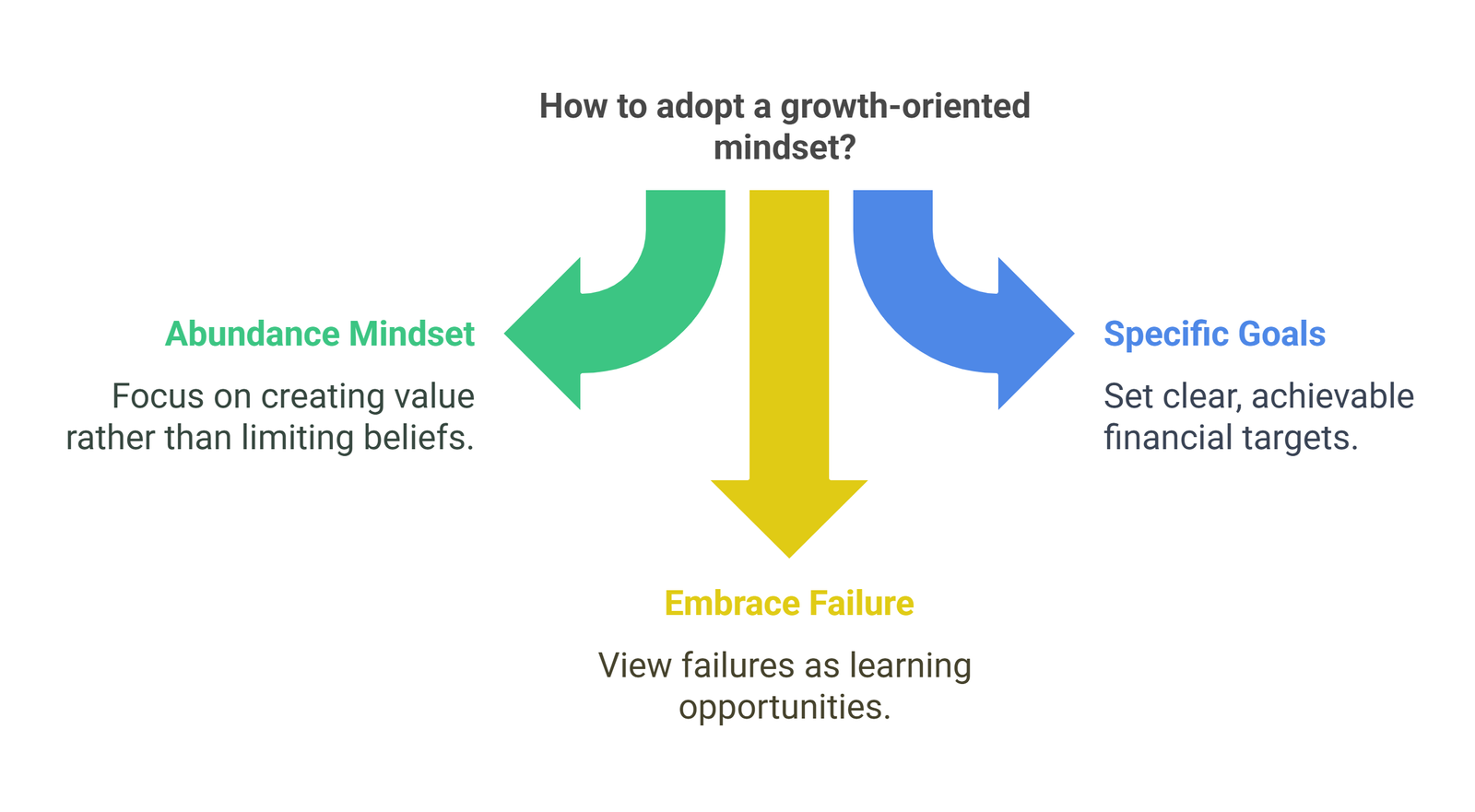

1. Mindset Shift: Trade Lottery Tickets for Legacy Plans

Wealth starts in your head. Swap the “get-rich-quick” mentality for what billionaire Warren Buffett calls “the snowball effect.”

- Abundance > Scarcity: Focus on growth, not fear. Instead of “I can’t afford this,” ask, “How can I create value to afford this?”

- Goals with Teeth: Vague dreams fail. Write down specific targets: “Save $10K in 12 months” or “Invest 20% of income.”

- Failure as Feedback: Thomas Edison didn’t “fail” 1,000 times—he found 1,000 ways not to make a lightbulb.

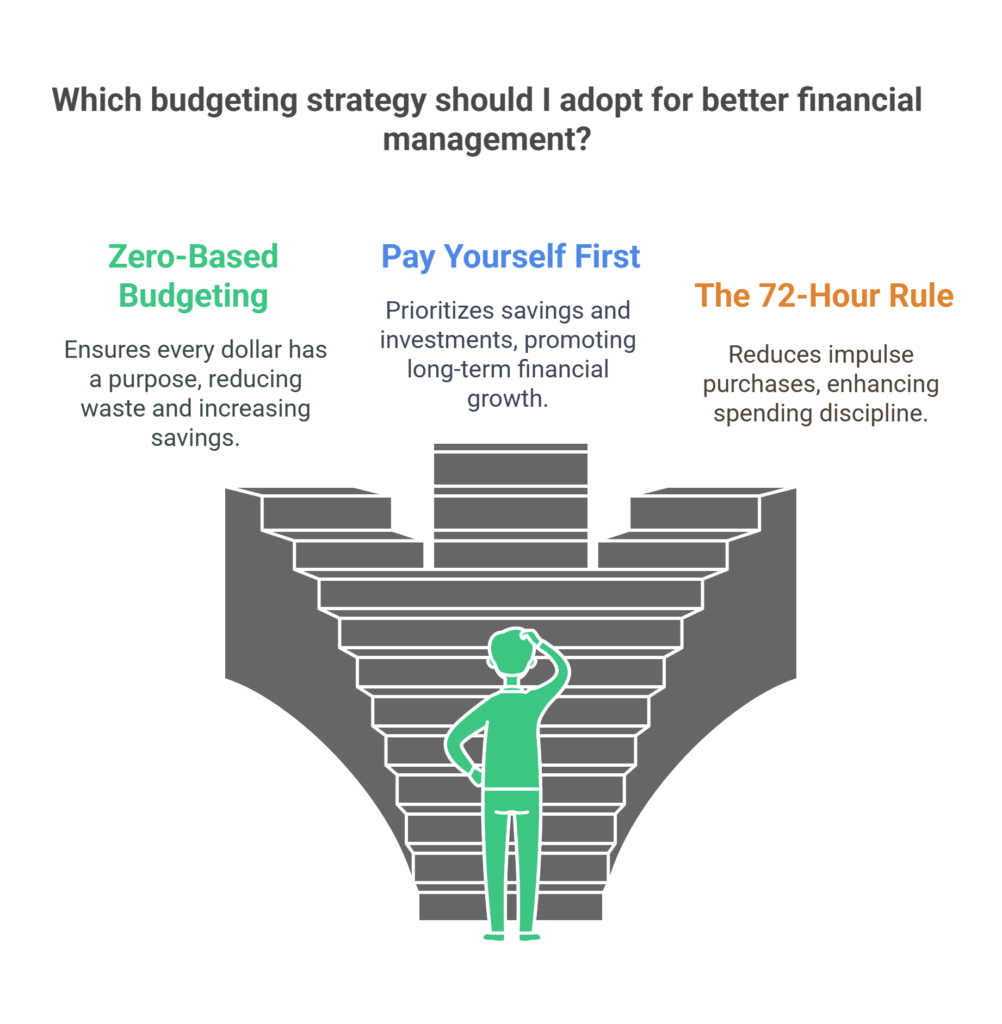

2. Budgeting: Your Financial GPS

Do you think budgeting is boring? Think again. A budget is your freedom plan—it tells your money where to go instead of wondering where it went.

- Zero-Based Budgeting: Give every dollar a job (saving, bills, fun). Apps like YNAB or Mint make this addictive.

- Pay Yourself First: Before bills, siphon 10-20% into savings/investments. Automate it—no willpower needed.

- The 72-Hour Rule: Impulse-buy? Wait 72 hours. If you still need it, go for it (spoiler: you usually won’t).

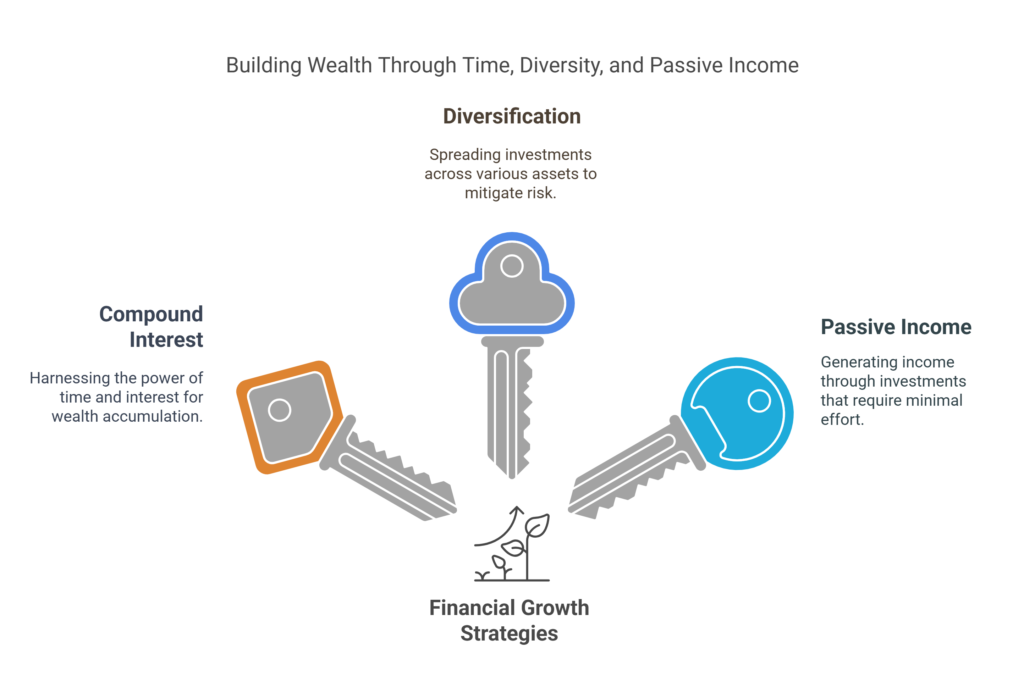

3. Invest Like a Pro (Even If You’re Not One)

Investing isn’t just for Wall Street wolves. It’s how money grows while you sleep.

- Compound Interest: The 8th wonder of the world. Start with 500/month at age 25. 1.4 million** (assuming 7% returns).

- Diversify or Die: Spread investments—stocks, ETFs, real estate, crypto (if you’re brave).

- Passive Income Machines: Rental properties, dividend stocks, or a side hustle that scales (e-books, courses).

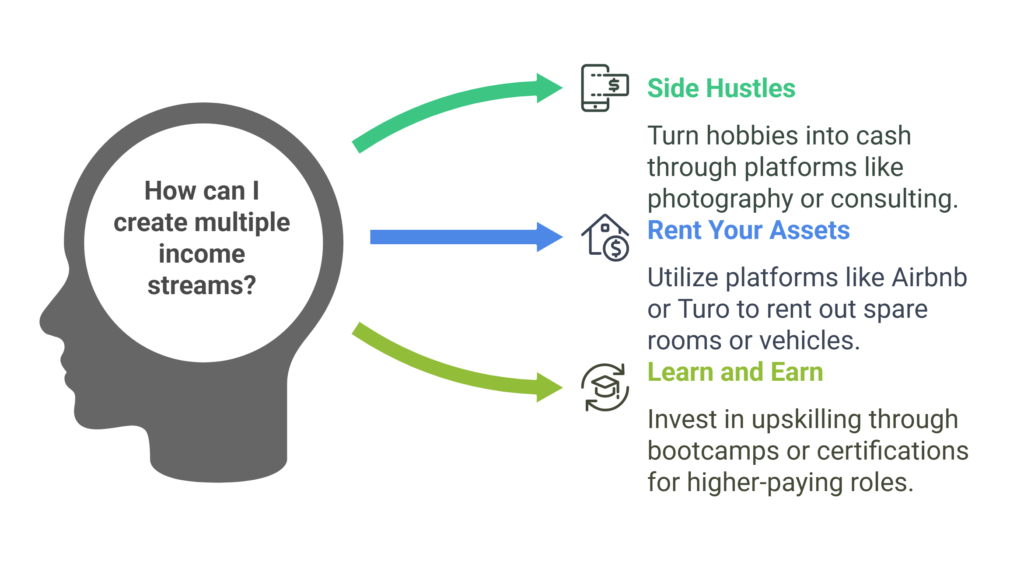

4. Multiple Streams > One Salary

The rich don’t rely on a single paycheck. They build income rivers:

- Side Hustles: Turn hobbies into cash (photography, consulting, TikTok reselling).

- Rent Your Assets: Got a spare room? Car? Camera? Platforms like Airbnb or Turo turn clutter into cash.

- Learn and Earn: Upskill for higher-paying roles. A coding boot camp or certification can boost income by 30%+.

5. Network Like Your Net Worth Depends on It (Because It Does)

Your circle = your financial future.

- Find Mentors: Surround yourself with people who’ve done what you want to do. Coffee chats are better than Netflix binges.

- Collaborate: Partner with others—joint ventures split effort and multiply results.

- Give First: Help others without expecting returns. Karma (and referrals) follow.

Conclusion: Your Wealth Blueprint Starts TODAY

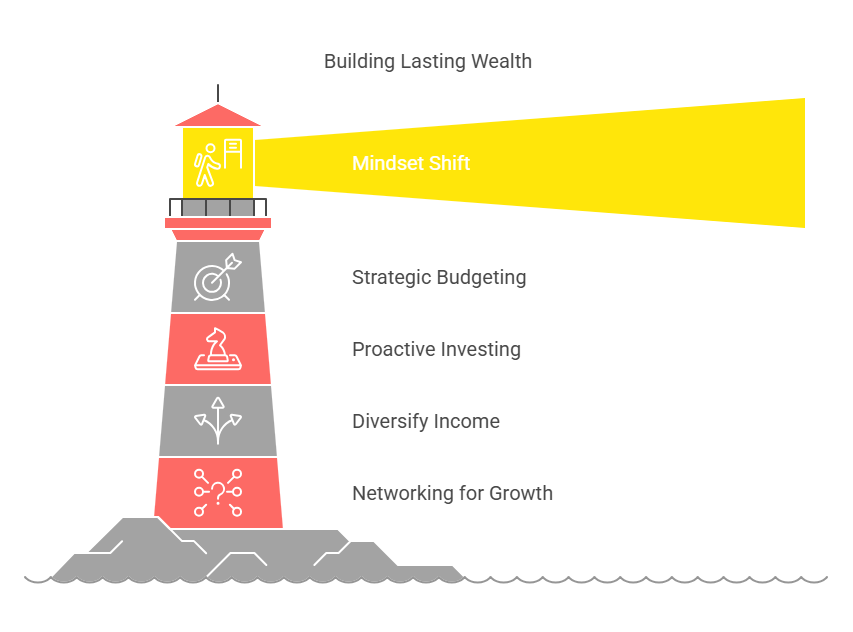

Wealth isn’t a lottery—it’s a ladder. Every rung is a strategic step: mindset, budgeting, investing, hustling, and connecting. The best part? You don’t need to be perfect—just persistent.

🚀 Your Move: Pick one strategy above and act this week. Open that investment account. Draft your budget. DM a potential mentor. Small steps compound into big wins.

Ready to level up? Drop your favorite strategy in the comments—let’s build wealth together.